Trade finance, the lifeblood of international commerce, has long relied on manual processes and paper-based documentation, leading to inefficiencies, delays, and security vulnerabilities. Blockchain technology, with its secure, transparent, and distributed ledger system, is poised to revolutionize trade finance by streamlining processes and enhancing security. Let’s delve into the transformative potential of blockchain in this domain:

Streamlining Trade Finance Processes:

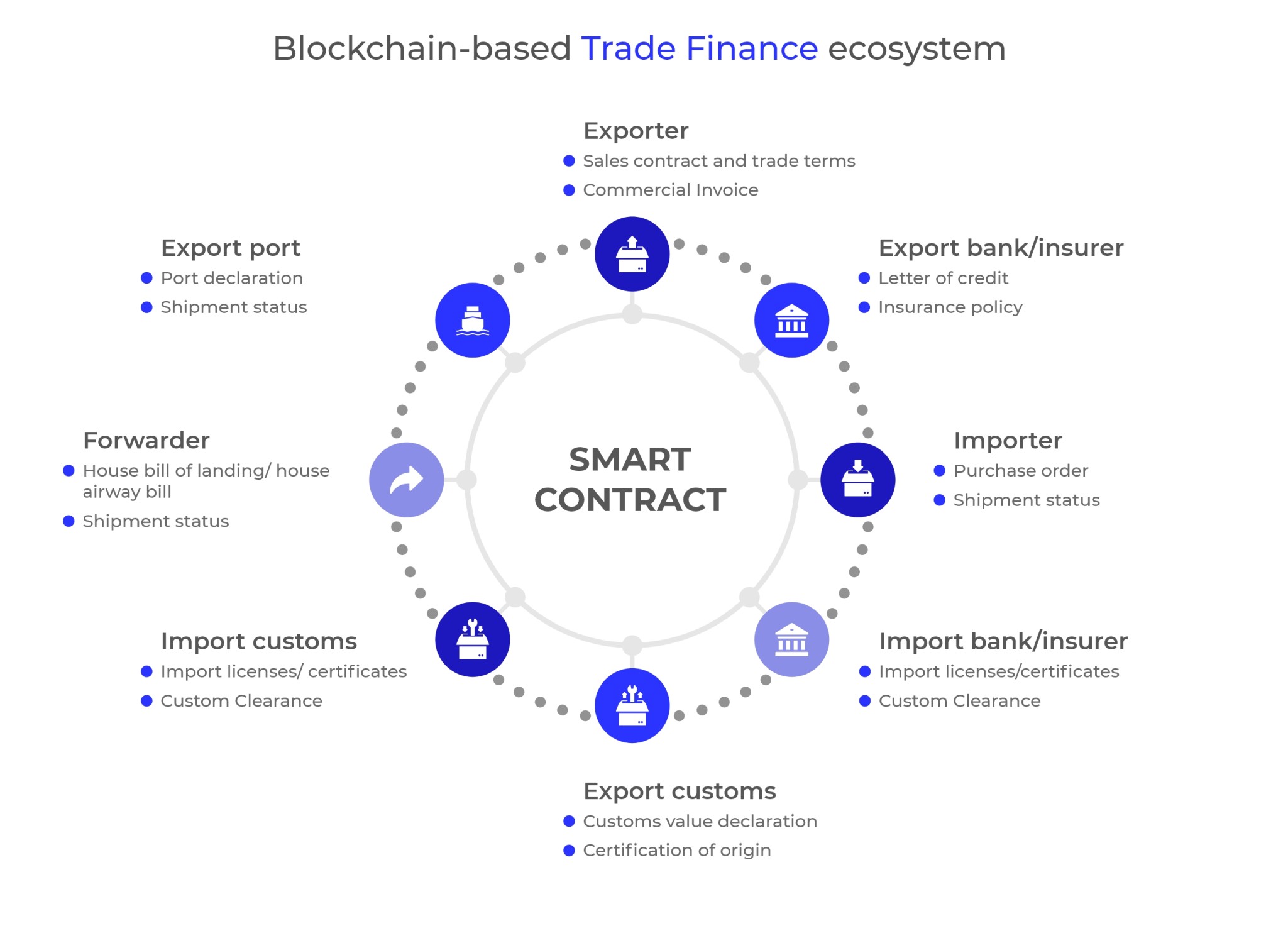

- Smart Contracts: These self-executing contracts automate key trade finance processes like letter of credit issuance, payment guarantees, and document verification. This eliminates manual tasks, reduces errors, and expedites transactions. (https://iccwbo.org/news-publications/news/icc-digital-initiatives-that-will-equip-business-for-the-next-century-of-global-trade/)

- Improved Visibility and Tracking: All transaction data is recorded on a shared, immutable ledger, providing all parties involved (buyers, sellers, financiers) with real-time visibility into the status of a transaction. This transparency fosters trust and reduces the risk of fraud.

- Reduced Paperwork: The decentralized nature of blockchain eliminates the need for paper-based documentation, reducing administrative burden and processing times.

Enhancing Security in Trade Finance:

- Immutable Ledger: Transactions recorded on a blockchain ledger are immutable, meaning they cannot be altered or tampered with, significantly reducing the risk of fraudulent activity.

- Enhanced Security Features: Cryptography and encryption protocols inherent in blockchain technology ensure the confidentiality and integrity of trade finance data.

- Reduced Counterparty Risk: By automating processes and increasing transparency, blockchain technology mitigates counterparty risk by reducing the potential for dishonorable actions by any party involved

Benefits of Blockchain in Trade Finance:

- Increased Efficiency: Streamlined processes and reduced administrative burden lead to faster transaction completion times and lower costs for all parties involved.

- Improved Transparency and Trust: The immutable ledger fosters greater transparency and trust between trading partners and financial institutions.

- Reduced Risk of Fraud: Enhanced security features minimize the risk of fraudulent activity and errors in trade finance transactions.

- Increased Access to Finance: Blockchain technology can facilitate trade finance for smaller businesses that traditionally face challenges securing funding from banks.

Challenges and Considerations:

- Standardization and Adoption: Widespread adoption of blockchain technology in trade finance requires standardization of processes and regulatory frameworks across different countries.

- Integration with Existing Systems: Integrating blockchain technology with existing trade finance systems can be a complex process for financial institutions.

- Scalability and Transaction Costs: Current blockchain technologies may not be scalable enough to handle the high volume of transactions associated with global trade.

The Future of Blockchain in Trade Finance:

Despite the challenges, the potential benefits of blockchain technology for trade finance are significant. As the technology evolves and regulatory frameworks adapt, we can expect increased adoption in the coming years. This will lead to a more efficient, secure, and inclusive global trade finance ecosystem.

Conclusion:

Blockchain technology represents a paradigm shift for trade finance. By streamlining processes, enhancing security, and fostering transparency, blockchain has the potential to revolutionize the way international trade is financed. Businesses and financial institutions that embrace this technology early on will be well-positioned to thrive in the global marketplace of tomorrow.