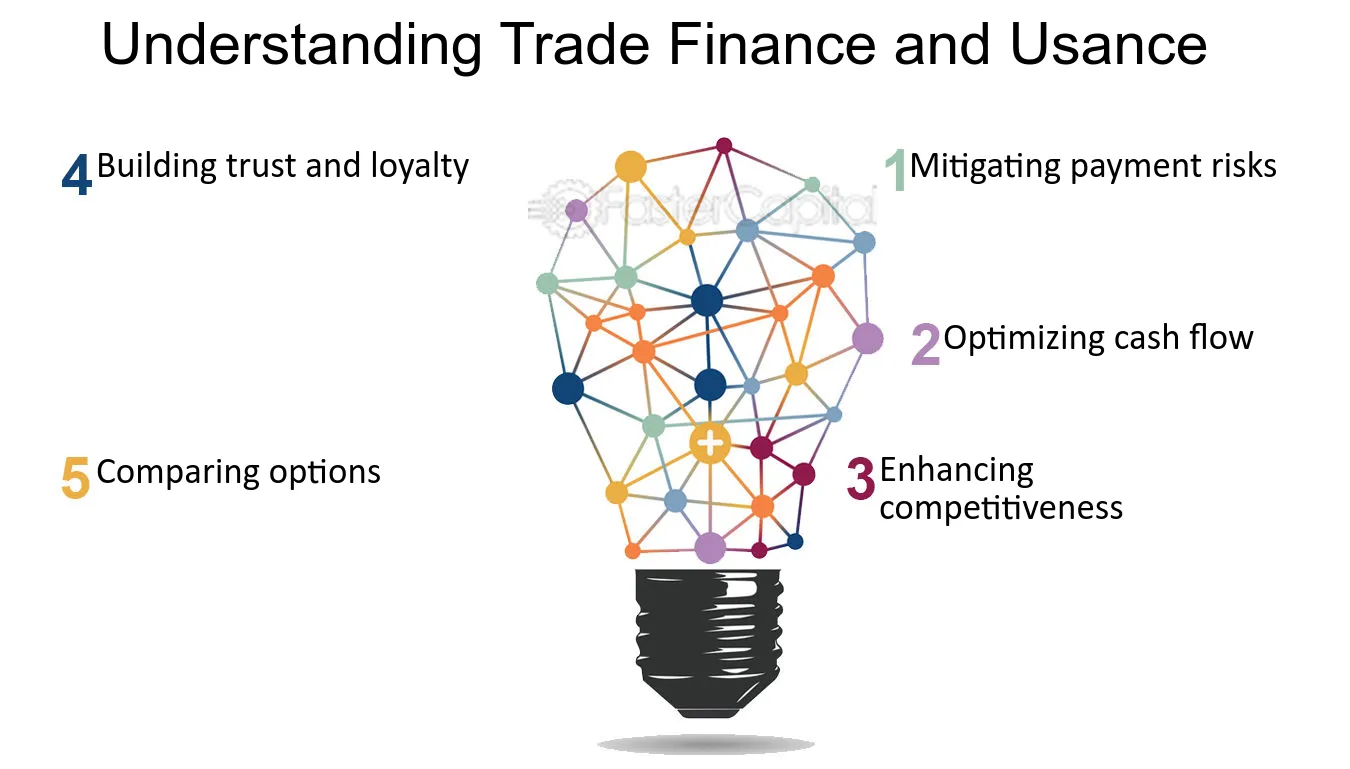

International trade is the lifeblood of the global economy, facilitating the exchange of goods and services across borders. However, the complexities involved in cross-border transactions necessitate specialized financial instruments and processes to mitigate risks and ensure smooth transactions. This is where international trade finance comes into play.

In this comprehensive guide, we will unravel the key terms and concepts that underpin international trade finance, empowering you with the knowledge to navigate this intricate landscape.

Understanding the Fundamentals of International Trade Finance

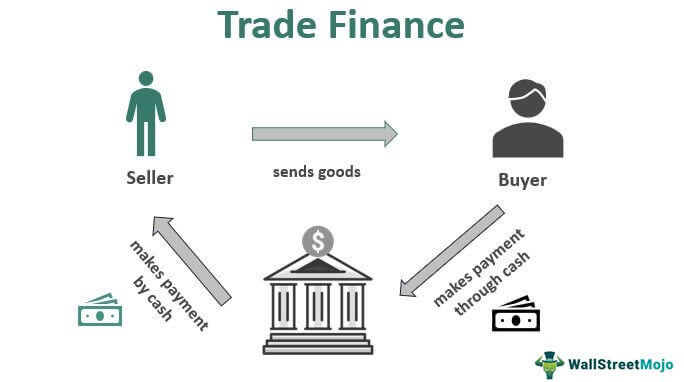

At its core, international trade finance encompasses various financial tools and services that facilitate cross-border trade. It addresses the challenges of payment security, risk mitigation, and working capital needs faced by both importers and exporters.

Key Players in International Trade Finance

- Exporter: The seller of goods or services in a cross-border transaction.

- Importer: The buyer of goods or services in a cross-border transaction.

- Banks: Financial institutions that provide various trade finance products and services.

- Export Credit Agencies (ECAs): Government-backed institutions that provide financing and insurance to exporters.

- Insurance Companies: Provide various types of insurance to cover risks associated with international trade.

- Freight Forwarders: Handle logistics and transportation of goods.

- Customs Brokers: Facilitate customs clearance processes.

Essential Trade Finance Instruments

-

Letter of Credit (LC): A document issued by a bank guaranteeing payment to the exporter upon presentation of specified documents that comply with the terms of the LC. LCs provide a high degree of security to both the exporter and importer.

-

Documentary Collection: A process where the exporter’s bank (remitting bank) sends shipping documents to the importer’s bank (collecting bank), which releases the documents to the importer against payment or acceptance of a draft.

-

Open Account: A method where the exporter ships goods before receiving payment, relying on the importer’s creditworthiness. This method offers flexibility but carries higher risk for the exporter.

-

Bank Guarantee: A guarantee issued by a bank on behalf of a buyer (applicant) to a seller (beneficiary), ensuring payment in case of default.

-

Trade Credit Insurance: Protects exporters from the risk of non-payment by foreign buyers.

-

Factoring and Forfaiting: These are financing techniques where exporters sell their accounts receivable (invoices) to a third party at a discount to get immediate cash flow.

-

Supply Chain Finance: Provides financing to suppliers in the buyer’s supply chain, improving their working capital and cash flow.

Risk Management in International Trade Finance

International trade is inherently risky due to factors like political instability, currency fluctuations, and non-payment by buyers. Trade finance instruments help mitigate these risks through various mechanisms:

- Credit Risk: The risk of non-payment by the buyer. This can be mitigated through LCs, bank guarantees, and trade credit insurance.

- Country Risk: The risk of economic or political instability in the buyer’s country. ECAs can help mitigate this risk.

- Currency Risk: The risk of exchange rate fluctuations. This can be mitigated through hedging techniques.

- Transportation Risk: The risk of damage or loss of goods during transit. This can be mitigated through cargo insurance.

The Role of Technology in Trade Finance

Technology is transforming the trade finance landscape, making it more efficient, accessible, and secure. Blockchain, smart contracts, artificial intelligence, and digital platforms are streamlining processes, reducing paperwork, and improving transparency.

Challenges and Opportunities in Trade Finance

While trade finance plays a vital role in facilitating global trade, it also faces challenges such as regulatory compliance, fraud, and access to finance for small and medium-sized enterprises (SMEs). However, ongoing innovations in technology and evolving regulatory frameworks are creating new opportunities to address these challenges and make trade finance more inclusive and effective.

Conclusion

Understanding the key terms and concepts of international trade finance is essential for businesses engaged in cross-border trade. By leveraging the right trade finance instruments and risk mitigation strategies, businesses can unlock new opportunities, expand their reach, and thrive in the global marketplace.