Understanding the Impact of Interest Rates on Your Finances: A Comprehensive Guide

Introduction

Interest rates play a crucial role in the financial world, influencing everything from the cost of borrowing to the returns on savings and investments. Whether you’re taking out a loan, investing in the stock market, or saving for retirement, understanding how interest rates affect your finance

s can help you make informed decisions and optimize your financial strategy.

s can help you make informed decisions and optimize your financial strategy.

This comprehensive guide will explore what interest rates are, how they are determined, and their impact on various aspects of personal finance, including loans, savings, investments, and overall economic health.

What Are Interest Rates?

Interest rates represent the cost of borrowing money or the return on savings and investments. They are expressed as a percentage and are influenced by central banks, inflation, and overall economic conditions.

Types of Interest Rates

- Fixed Interest Rates – Remain constant over the loan or investment period.

- Variable Interest Rates – Fluctuate based on market conditions.

- Nominal vs. Real Interest Rates – Nominal rates do not account for inflation, while real rates adjust for inflation.

How Interest Rates Are Determined

Interest rates are set by central banks, such as the Reserve Bank of India (RBI) or the Federal Reserve in the U.S. They adjust rates based on:

- Inflation levels – Higher inflation often leads to higher interest rates.

- Economic growth – Strong economic activity may prompt higher rates to prevent overheating.

- Monetary policy – Central banks use interest rates to control money supply and stabilize the economy.

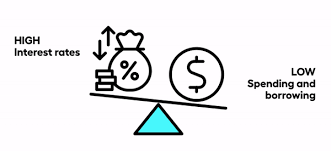

Impact of Interest Rates on Your Finances

1. Loans and Mortgages

- Higher interest rates make borrowing more expensive, increasing monthly loan payments.

- Lower interest rates reduce borrowing costs, making loans more affordable.

2. Savings and Investments

- Higher interest rates benefit savers by offering better returns on fixed deposits and savings accounts.

- Lower interest rates encourage spending and investment but reduce returns on savings.

3. Stock Market and Real Estate

- Rising interest rates can lead to lower stock prices as borrowing costs increase for businesses.

- Real estate investments may slow down with higher mortgage rates, making homeownership more expensive.

Strategies to Manage Interest Rate Changes

- Refinance Loans – Consider refinancing debt when interest rates drop.

- Diversify Investments – Allocate assets across stocks, bonds, and fixed-income instruments.

- Optimize Savings – Take advantage of higher interest rates by using high-yield savings accounts.

Conclusion

Interest rates significantly impact financial decisions, from borrowing to investing. Staying informed about rate changes and adjusting your financial strategy accordingly can help you navigate economic fluctuations effectively. By understanding how interest rates work, you can make smarter financial choices and secure your financial future.